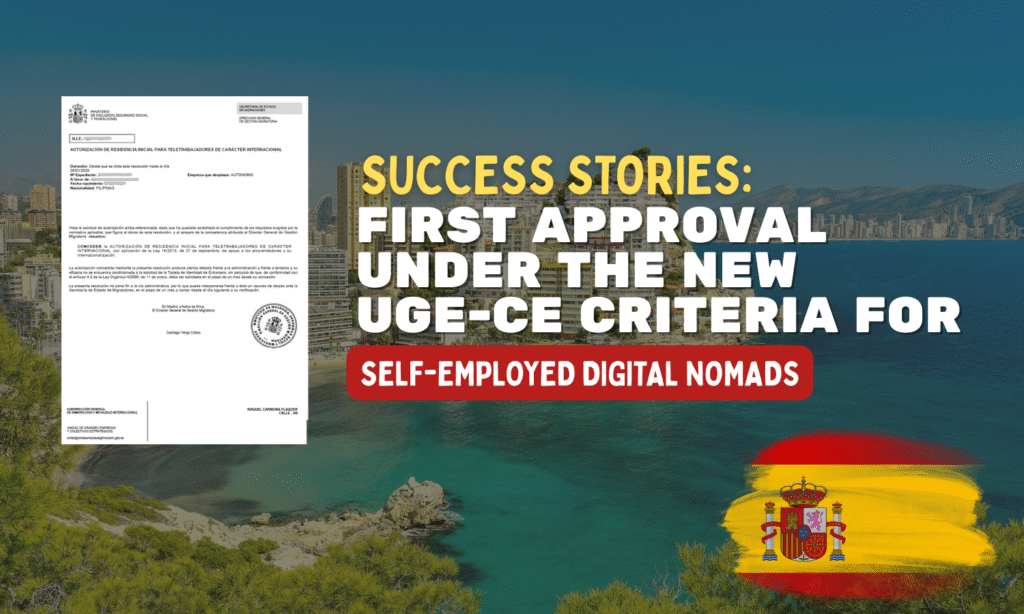

In late November 2025, an annual immigration conference was held in Spain, where several concerns were raised regarding the interpretation of immigration regulations. Among the topics discussed were recent changes in the criteria applied by the UGE-CE (Unidad de Grandes Empresas y Colectivos Estratégicos) to the Digital Nomad residence permit, one of the most recent residence categories that continues to evolve in practice.

As with many newly implemented residence permits, the Digital Nomad framework is subject to ongoing adjustments and refinements in interpretation, particularly as the Administration gains experience handling different applicant profiles.

Recent change in criteria: proof of self-employment

One of the most significant recent changes affects freelance digital nomads. To verify the duration and legitimacy of their professional activity, the Administration now requires proof that applicants are registered as self-employed in their country of origin, where such registration may exist as a legal requirement.

As a result of this change, for applications submitted in late November 2025, the Administration began requesting additional documentation to verify self-employment, as follows:

“The applicant must prove their registration in the self-employed workers’ registry of the country of origin. The certificate must be duly apostilled or legalized and translated by a sworn translator recognized by the Ministry of Foreign Affairs, European Union and International Cooperation. In countries where such a registry does not exist, this may be justified by one of the following documents: tax registration certificate, proof of enrollment in a self-employed tax regime, certificate of affiliation to the social security system for independent workers, business license or municipal permit, registration with the chamber of commerce or equivalent, annual tax return showing independent activity, tax payment receipts (VAT, income tax, GST), certificate of registration in an economic activities census, or registration as a sole proprietorship or equivalent.”

This clarification has a direct impact on freelancers from jurisdictions with different regulatory frameworks, where immediate registration as self-employed may not be required at the start of their activity, or where such a registration system does not exist at all.

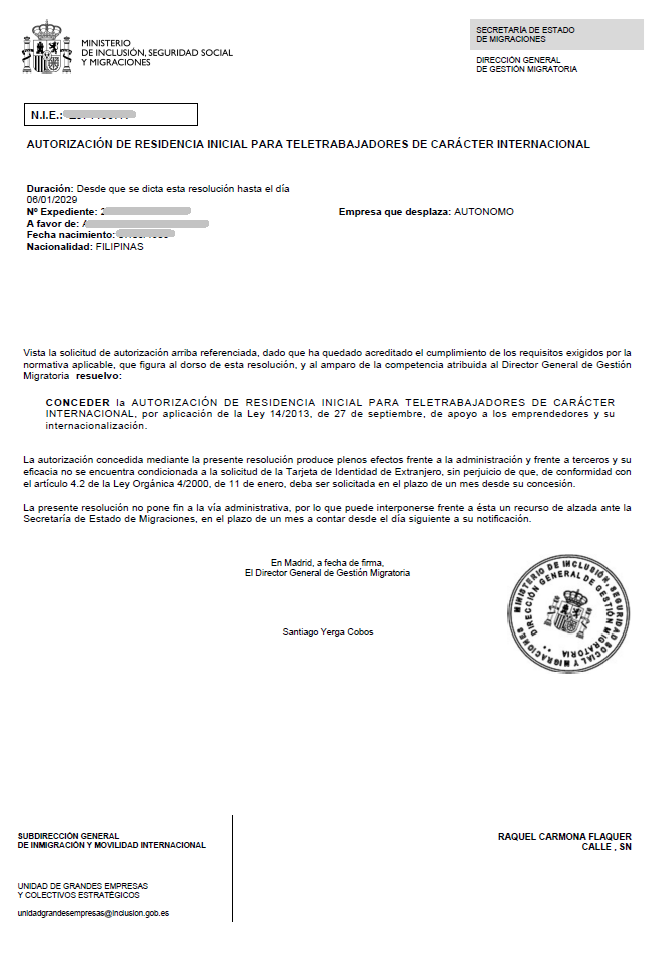

The Client’s Situation: Filipino Contractor for a UAE Company

Our client, a Filipino national working as a contractor for a company based in the United Arab Emirates, had been engaged in independent work for approximately three months at the time of her application. Prior to this, she had maintained a standard employment relationship with the same company, which was later converted into a freelance agreement to allow her to pursue new professional opportunities while residing in Spain..

Under UAE regulations, immediate registration as self-employed is not mandatory, with formal registration typically occurring later depending on income, frequency of services, or other local legal requirements. This situation is fully comparable to the treatment of contractors under Spanish law, where registration timing can also vary based on similar criteria.

Legal strategy and evidence provided

To demonstrate good faith, registration with the home country’s social security system was initiated immediately, within the 10-working-day period allowed to respond to the Administration’s request.

Although the minimum three-month registration period had not yet been completed, the professional relationship was fully substantiated through:

- Freelance invoices

- A formal freelance contract signed in early August 2025

- Documentation of prior employment

- Proof of the definitive termination of the employment contract on 16 September 2025

Together, these documents clearly demonstrated continuity of professional activity, despite the transition from an employee to a self-employed contractor with the same company.

Outcome and relevance

The application was ultimately approved, becoming one of the first cases resolved favorably under the new UGE-CE criteria for self-employed digital nomads.

Practical conclusion

This case highlights that, for Digital Nomad residence permits, compliance with the formal requirements alone may not be sufficient. Understanding how the Administration interprets self-employment criteria and preparing the application strategically is crucial.

For freelance applicants from countries with different regulatory systems, legal analysis, contextual reasoning, and strategic documentation can make the difference between a stalled application and approval.

At MigratioLex, we monitor changes in administrative criteria and tailor each application to ensure the applicant’s situation is accurately represented and defended.

If you are considering a Digital Nomad residence permit or have received a request for additional documentation, contact us to review your case and plan the best legal strategy.